Introduction

Michael Saul Dell, the Texas techno‑whiz turned billionaire, fires on all cylinders as founder, chairman, and CEO of Dell Technologies—an infrastructure powerhouse that keeps the digital world humming. He kicked off this revolution in 1984 from his dorm at UT Austin, selling custom‑built PCs directly to eager customers and blowing up the old‑school retail playbook. By 2001, Dell had rocketed to the top of PC sales charts, and today his company dukes it out for third place behind Lenovo and HP on the global stage.

In a blockbuster move in 2016, he fused his company with EMC in a $60 billion deal, giving rise to Dell Technologies—an end‑to‑end tech juggernaut for servers, storage, and cybersecurity. Now, Dell’s eye for the future powers innovations in cloud services, data safety, and digital makeovers, arming companies everywhere to build, upgrade, and safeguard their digital empires.

Early Life and Career

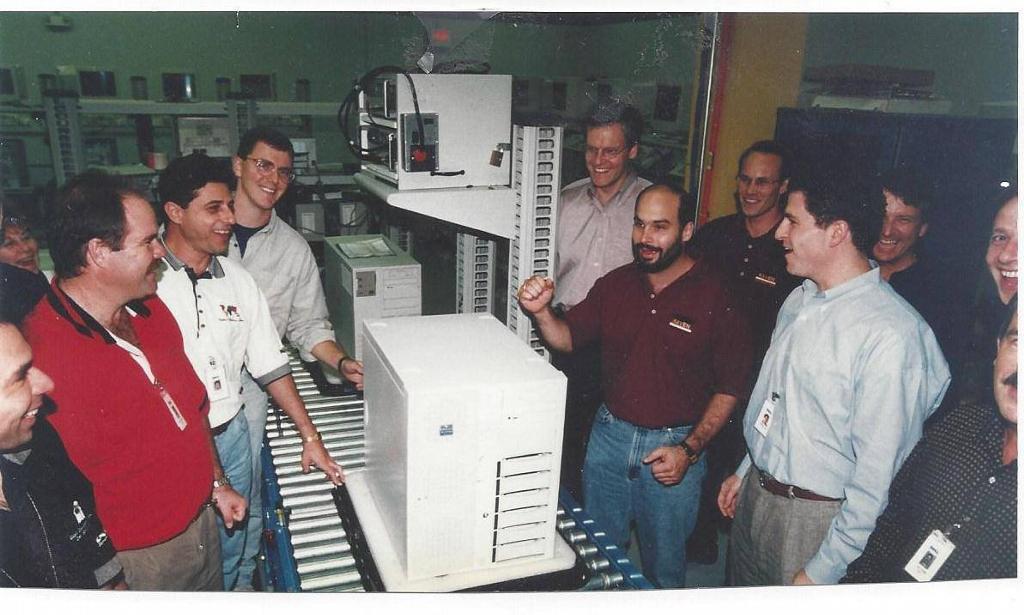

Born on February 23, 1965, in Houston, Texas, to orthodontist Alexander Dell and stockbroker Lorraine Langfan, Michael Dell grew up in a family that valued education and hard work. At age 15, he famously took apart and rebuilt an Apple II computer simply to understand its inner workings, sparking a lifelong fascination with technology. Even before high school, Dell demonstrated entrepreneurial flair—selling stamps at age 12 and earning $18,000 from newspaper subscriptions at 16. He attended Spring Branch Memorial High School in Houston, where he excelled in hands‑on projects more than traditional academics. In May 1984, while a freshman pre‑med student at the University of Texas at Austin, he launched PC’s Limited with just $1,000 in startup capital.

By the end of his first semester, his venture had already generated $80,000 in sales, validating his direct‑to‑consumer model. At age 19, Dell dropped out of college to focus on his rapidly growing business full‑time. He renamed the company Dell Computer Corporation and sustained annual growth rates near 80 percent throughout the late 1980s. In June 1988, at age 23, Dell took the company public, raising $30 million in its initial offering and achieving an $85 million market valuation. These early achievements laid the groundwork for his meteoric rise—eventually becoming the youngest CEO to lead a Fortune 500 company at age 27.

Net Worth and Source of Wealth

As of April 18, 2025, Michael Saul Dell’s personal fortune is estimated at $90.7 billion, placing him 15th on the global rich list. This wealth is predominantly tied to his roughly 43% stake in Dell Technologies, which he holds directly following a December 2024 Form 4 filing. A sizable portion also comes from his approximately 41% interest in VMware after Dell’s 2016 EMC merger, a stake that continues to generate value through spin‑offs and dividends.

Beyond core tech holdings, Dell’s family office, DFO Management (formerly MSD Capital), manages diversified portfolios that include landmark real estate deals in New York and Miami. He also directs early‑stage technology investments through Dell Technologies Capital, which has deployed more than $1.7 billion in funding across cybersecurity, AI, and infrastructure startups. He periodically adjusts his public equity positions to support philanthropic initiatives such as the Michael & Susan Dell Foundation and reinvest in emerging technologies, underscoring a dynamic strategy for preserving and growing his assets. He also owns a photography print collection, adding an art‑investment dimension to his portfolio.

Properties and Mansions

Michael Dell’s real estate holdings span both city‑center residences and vast private retreats, reflecting a blend of luxury and strategic capital allocation. In 2014, he acquired the record‑breaking One57 penthouse in Manhattan for $100.47 million on the 89th/90th floors, with panoramic Central Park views. In Boston, Dell listed two Four Seasons penthouses for about $35 million each, with private terraces, wide windows, and full hotel‑style services.

West of Houston, his 6D Ranch stretches across thousands of acres for family retreats and recreational hunting, showcasing his love of wide‑open landscapes. In Austin, the Lake Austin “Castle” estate features a main residence, guest cottages, a resort‑style pool, and meticulously landscaped grounds across ten acres. Many homes use Crestron touch panels for lighting, climate, audio, and security, and feature solar panels and energy‑efficient glazing.

Cars And Jets

For long‑haul travel, Dell favors a Gulfstream G650—an ultra‑long‑range business jet capable of nonstop flights over 7,000 nautical miles, with plush seating, conference suites, and inflight connectivity. The G650’s Mach 0.85+ cruise speed and low cabin altitude ensure Dell arrives refreshed and ready for high‑stakes meetings, minimizing jet‑lag on intercontinental routes. Prior to the G650, he briefly owned one of the world’s only private Boeing 787 Dreamliners—customized with lounge areas, private staterooms, and full‑service galleys for executive comfort.

Although he later sold the Dreamliner, the $900 million jet underscored his commitment to bespoke aviation solutions for an ultra‑high‑net‑worth lifestyle. On the ground, his garage includes a Porsche Carrera GT and a Hummer H2—vehicles that balance raw performance with everyday utility and reflect his dual passion for speed and practicality. Together, these assets illustrate Dell’s philosophy of leveraging best‑in‑class technology—whether in the sky or on the road—to maintain peak efficiency in global business endeavors.

Business Ventures

Michael Dell established MSD Capital in 1998 to manage his family’s investment portfolio, spanning private equity, real estate, and venture capital. He co‑founded the Michael & Susan Dell Foundation in 1999 to improve education, health, and economic opportunities for disadvantaged families. To date, it has invested over $1.2 billion globally, reaching millions with learning tools and health services.

On the corporate side, Dell orchestrated the $67 billion EMC acquisition in 2016, integrating storage and cloud solutions under Dell Technologies. His 2011 purchase of SecureWorks expanded cybersecurity offerings, and a 2019 VMware‑Pivotal merger added cloud‑native services. Through Dell Technologies Capital, launched in 2012, he has deployed over $1.7 billion into 160+ AI, IoT, and cybersecurity startups. He also pledged $36 million to Hurricane Harvey relief and funds global disaster recovery and community development.

Conclusion

Michael Saul Dell’s transformation from a 19‑year‑old college freshman assembling PCs in his University of Texas dorm to the architect of Dell Technologies embodies the power of entrepreneurial vision and customer‑centric innovation. By pioneering a direct‑to‑consumer model, he disrupted the personal computer industry and grew a $1,000 family investment into $73 million in first‑year revenue for PC’s Limited. Under Dell’s leadership, the company expanded beyond PCs into servers, storage, and enterprise solutions, culminating in the landmark $67 billion acquisition of EMC in 2016—the largest pure‑technology merger at the time. A visionary strategist, Dell guided his company through a 2013 leveraged buyout, a triumphant return to public markets in 2018 via a VMware share swap, and ongoing investments in cloud computing and artificial intelligence, ensuring Dell Technologies remains at the forefront of digital transformation. Beyond corporate achievements, Dell’s philanthropic endeavors through the Michael & Susan Dell Foundation have directed billions toward education and healthcare initiatives, demonstrating his commitment to social impact alongside business success. Thank you for reading! We appreciate your feedback—please like, share, and comment with your thoughts, and be sure to explore our other articles for more insights into today’s tech leaders.

Comments